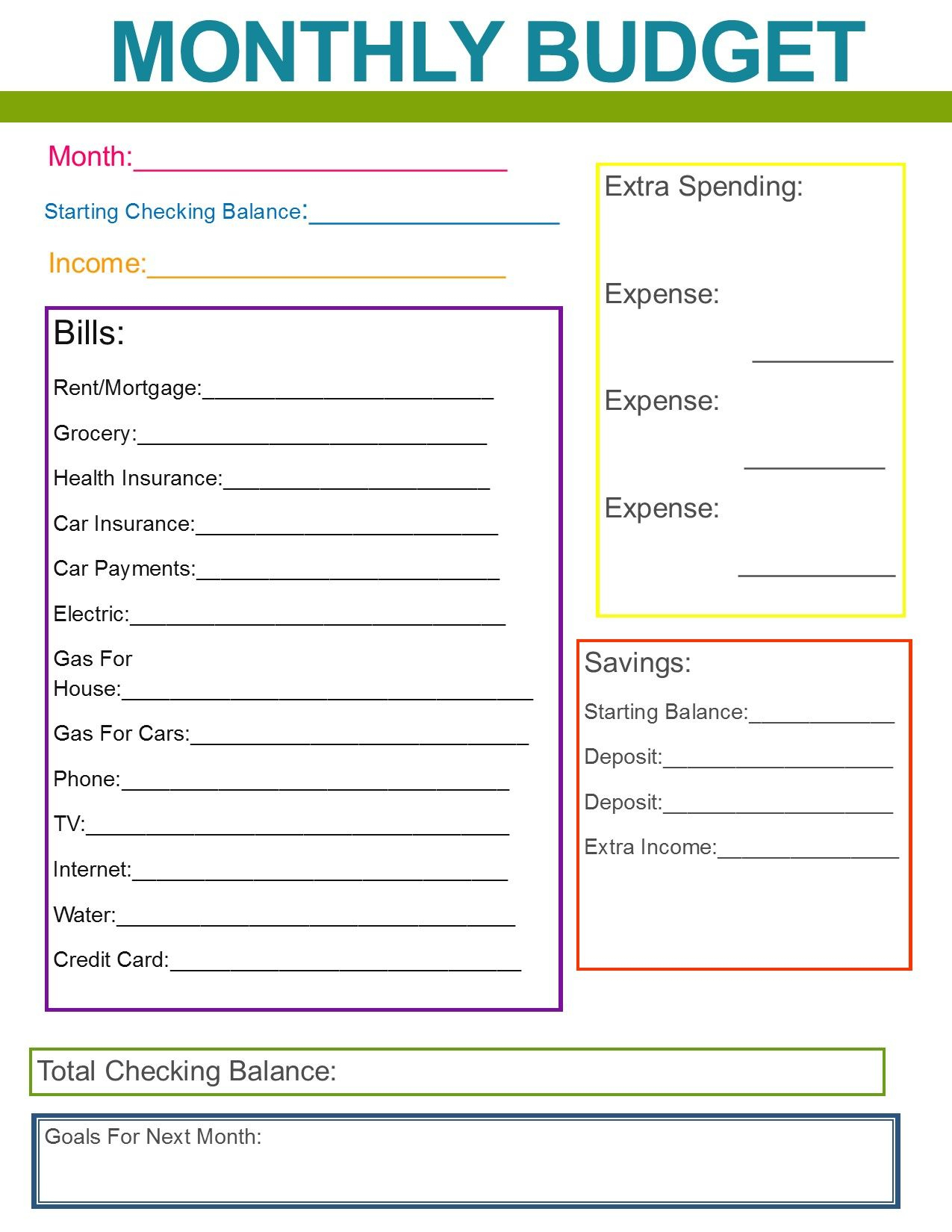

Enter the amount of your monthly mortgage payment in the mortgage box, or the amount of your monthly rent in the rent box of the budget calculator. Mortgage or Rent: Whether you own or rent, you’ll need to factor in your housing expenses. Others, like groceries and entertainment expenses, will be estimates.

Some of these costs, like rent and car payments, will be specific numbers. Once you’ve figured out how much money you’re bringing in each month after taxes, you’ll need to figure out how much you need to spend on your monthly expenses.

Household budget template how to#

Step 2: How to determine and enter monthly expenses

You can also use this section to add a second income if you’d like to create a joint budget. If you have additional income such as a side hustle, or you receive child support, alimony, or other supplemental income, add that monthly amount under Other Income. If the last 3 months were unusually high or low, add up all your deposits for the past year instead and divide by 12 to get a better average. Enter that amount in the budget calculator.

Remember, this is the amount you can spend every month, so be sure to use your net income - which is the money you’re left with after taxes and deductions for things like health insurance and your 401(k), not your gross income, which is your total pay before any deductions. Ready to get started? To use our monthly budget calculator, first you need to figure out your monthly income. Build your budget in 3 easy steps Step 1: How to figure out your monthly income

0 kommentar(er)

0 kommentar(er)